tl;dr Summary: Terra Network’s stablecoin, UST, crashed due to a bank run on the token. The stabilization mechanisms that were meant to keep its $1 peg directly contributed to the crash of the network’s native coin LUNA. NEAR Protocol’s stablecoin, USN, shares similar characteristics to UST that may make it susceptible to a similar bank run.

If you have hung around crypto for the last few weeks, you have likely heard about the drama surrounding stablecoins. LUNA crashing, the depeg of UST, and concerns over stablecoins; This single incident with the Terra Network has thrown the crypto world for a spin and the question on everyone’s mind is whether the disaster that befell LUNA is going to stop there. To better understand that question, we first need to understand stablecoins, UST, and comparable tokens.

Stablecoin Summary:

As discussed in other articles, stablecoins are digital asset tokens that derive and peg their value to another currency, commodity, or financial instrument. Crypto has found a few creative ways to do this:

1) Algorithmically Stabilizing: a stablecoin that stabilizes the price of the token through minting and burning to adjust the token supply to maintain a consistent value

2) Fiat Backing: a stablecoin has a reserve of fiat currency, like the US dollar, to make sure that the token can be pegged to dollars in reserve

3) Crypto Backing: a stablecoin that is backed by reserved and staked cryptocurrency

4) Commodity Backing: a stablecoin that is backed by physical assets like gold, oil, or even real estate

Cryptocurrencies don’t have to fall into just one of these categories. Network created stablecoins like UST and USN take attributes from both algorithmically-stabilized and crypto-backed categories to maintain their peg. For the purposes of this article, we will focus on network created stablecoins that mix these two categories to reach their peg to better understand whether the challenges that UST had/have permeate to other stablecoins.

UST Recap:

So then, how did UST use algorithmic stabilizing and crypto backing to achieve a peg before it crashed?

Algorithmic Stabilizing: The first component to UST’s price stabilization is algorithmic stabilization of the token. In simple terms, algorithmic stabilization is just the burning and minting of a token to equalize the price of a coin. For UST, users are allowed to mint 1 token of UST for burning the equivalent of $1 of LUNA. This works the other way around where users of LUNA can mint $1 of LUNA for the burning of 1 token of UST.

This ability to exchange is essential to the stability of LUNA and UST since it allows users to cash out of the stablecoin for a gain if it drops below $1 and allows LUNA holders to mint $1 of LUNA into a token of UST for a gain if the price of the token is above the $1 peg.

While the algorithmic stabilization is clever, it does come with some flaws. One primary flaw is its heavy reliance on the network’s native coin, LUNA, maintaining a reasonable value. If the interest and value in LUNA ever drops significantly, say in a mass burning of UST to mass minting of LUNA, then this could significantly impact users’ ability to exit the network without significant losses. This is because the supply of LUNA would be too high, and the demand would be too low for users to get their money back. In a mass panic, like what happened when LUNA crashed, users are stuck holding millions of LUNA coins that are deteriorating in value with no way to exchange them into USD.

LUNA Foundation Guard (LFG) Reserves: This is where the reserve of LUNA was supposed to kick in. LFG acted as the reserve for the LUNA network and was supposed to back UST in the case of a mass exit from the network. They would do this by buying up the extra supply of LUNA created from users leaving UST. The issue comes when the reserves on hand are only a fraction of what is needed to support the entire LUNA ecosystem. To get a quantum of just how under-reserved LFG was, they held approximately $4 billion in reserves when the LUNA network had a market cap of $18 billion. So, when users did a mass exodus from UST to LUNA and the members of the LUNA network collectively wanted to exit, the reserve couldn’t maintain the price of the coin. The result was hyperinflation. The original supply of LUNA, which was approximately 340 million coins before the chaos exploded, skyrocketed in just a few days to over 6 trillion making the value of each individual coin virtually worthless.

So, there are several issues that a stablecoin that utilizes algorithmic stabilization and crypto backing face: the first is how their system handles minting and burning and the second is the network’s ability to maintain the value of their crypto through their reserves.

What is USN:

In a previous article, we mentioned the establishment of USN but didn’t go into much detail into the technical functionality of the stablecoin as it relates to others. To understand whether USN is at risk for a similar crash to UST, we first need to compare USN to UST across the areas above.

Minting/Burning: One key difference between UST and USN is the way that minting new stablecoins is done. As discussed above, when UST is created, $1 of LUNA is burned. In the Near Protocol, when a USN token is minted, the $1 of NEAR used to mint a USN token is staked, not burned. The difference here is that the minting and burning of USN does not impact the supply of NEAR coins. This fundamental distinction better protects USN from a ‘death spiral’ or the hyperinflationary minting of a network’s coin in response to the stablecoin losing its $1 peg.

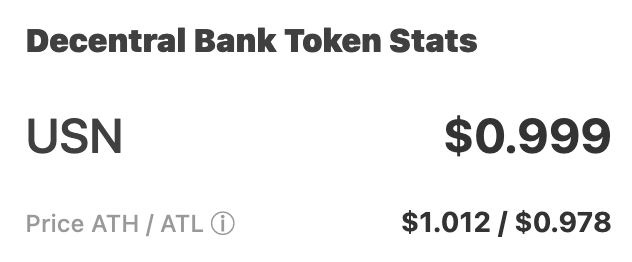

Cash Reserves: The next difference is USN’s fully collateralized reserve. USN, at launch, is only allowing $1 billion USN to be minted. The Decentral Bank DAO, which NEAR Protocol has partnered with, has $1 billion of reserves in the form of USDT in the case of a bank run on USN. The protocol believes that these two safeguards of limited stablecoin minting and 1:1 stablecoin collateralization will protect the network against price fluctuation and potential bank runs.

While these changes provide substantial safeguards against a bank run compared to UST, there are still some risks associated with these crypto-backed, algorithmically-stabilized stablecoins. The primary risk with these types of stablecoins seem to lay with the strength of their native coin. UST, USN, and Tron’s stablecoin USDD all achieve stability through the arbitrage—guaranteed switching—between a single token of the stablecoin and $1 of the network’s native coin.

Is USN a Risk?

If we look back and learn from the mistakes of UST, it is clear that despite USN’s differences in minting and reserves, there are still some underlying risks that network backed stablecoins like USN have. While some might indicate that the issues with Terra’s stablecoin had to do with their mechanisms, the main issue came when the network wasn’t able to effectively stabilize the price of their native coin.

It is true that the mass burning of the stablecoin and subsequent minting of the network coin did start the death spiral. The ultimate issue lies with a network’s ability to stabilize their native coin’s price. If a network can’t stabilize their native coin’s price in the case of a bank run it only encourages more users on the network to exit. These spirals don’t happen when people exchange back into the native coin; it happens when network users no longer believe in the native coin and/or network itself.