Is this the beginning of the end for Celsius, or is there a silver lining?

tl;dr Summary: On the night of June 12, amidst a crypto bear market, Celsius, a lending and borrowing platform, announced that it is pausing all customer withdrawals, swaps, and transfers.

“We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations,” their memo stated. The reason for this move was “for the benefit of our entire community to stabilize liquidity and operations while taking steps to preserve and protect assets. Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to our customers.”

Celsius is a lending platform that offers its customers high yields (as high as 17%) on their crypto deposits which it lends to other crypto firms. The company’s CEL token reacted sharply, dropping 70% in one hour from a high of $0.49 on Sunday to $0.15 after the announcement.

In response to this event, BlockFi (another lending platform) CEO Zac Prince tweeted that its services “continue to operate normally.”

The tweet suggests exposure to stETH as the primary reason for Celsius’s current situation.

stETH or staked Ethereum is a tokenized form (a.k.a. derivative or synthetic) of Ether token. It is native to Lido, a platform that provides liquidity for staked assets, allowing users to stake their ETH and earn staking rewards.

But how does this give liquidity to the user?

Lido allows users to mint “staked tokens” like stETH, pegged 1:1 to their initial stake. stETH is what provides liquidity by enabling users to get even more yield by lending or yield-farming on platforms like Aave and Curve. This process of getting yield on top of yield is called rehypothecation or leveraged trade.

This kind of leveraged trade possibly explains Lido’s growth too.

This is all good news in a bull market; however, a bear market with falling ETH prices is different. Market conditions created a 2-3% gap between the price of stETH and ETH, which triggered significant withdrawals of stETH. Amber, a crypto investment platform, withdrew $128 million from the curve pool, adding to the selling pressure on stETH. This resulted in further increasing the gap and even more selling pressure.

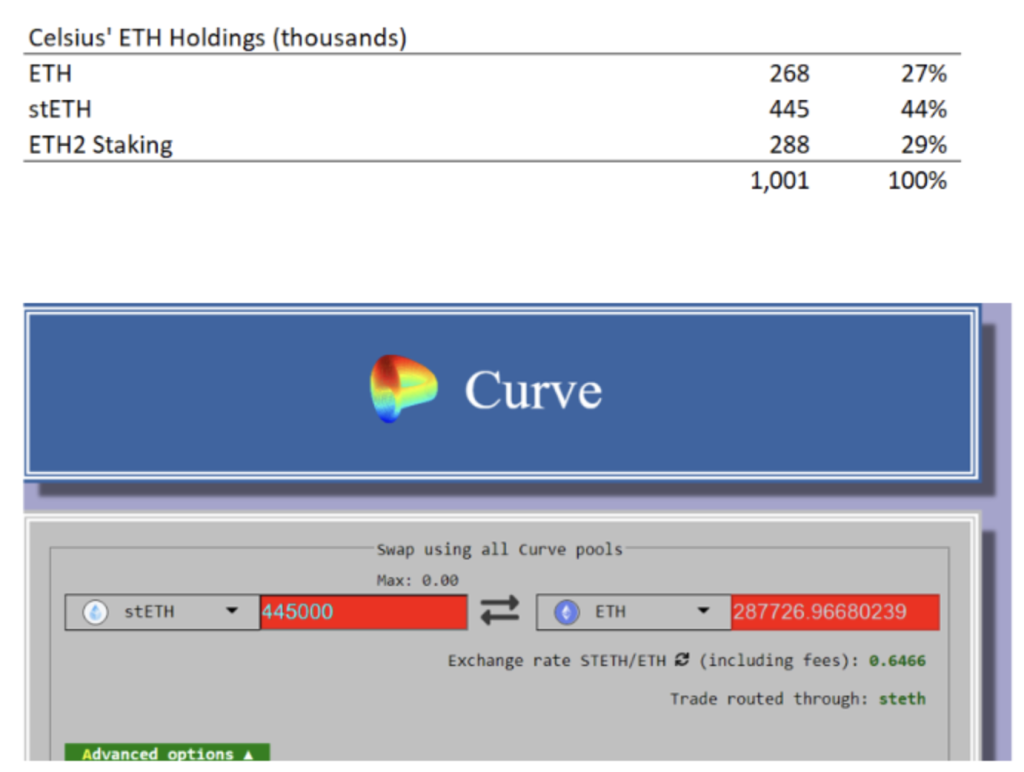

Celsius, too, had considerable exposure to stETH. Out of its 1 million ETH holding, only 27% was in the actual ETH token, whereas 44% was in the form of stETH. The rest was locked on the new beacon chain, making it inaccessible until after the merge.

This means if people start withdrawing from Celsius beyond its liquid reserves of actual ETH, they will have to sell their stETH, worsening the situation.

With the mounting sell pressure in the overall market, Celsius started to see its outflows grow. In the first week of May, its outflow topped $1 billion.

Then came the UST-LUNA blowout that single-handedly wiped out the market’s $60 billion in value, adding to even more selling pressure in the market. Celsius struggled to keep paying out its aggressive yield as investors pulled liquidity out faster, so they decided to stop withdrawals.

It is one thing if this had happened to a company that understood the risks it took and put an appropriate mechanism in place to deal with such an eventuality, but Celsius’ past does not help bring out such confidence.

In June 2021, Celsius lost 35,000 ETH when an Ethereum staking service Stakehound “misplaced” 38,000 ETH, but CEO Alex Mashinsky chose not to inform his users about the loss.

Celsius also lost $22 million after “mistakenly” forfeiting restitution payments from the Badger DAO hack.

It does not end here. On-chain analysis shows that Celsius had also made substantial deposits of at least 261,000 ETH, totaling around $500 million USD, to Terra’s Anchor protocol. Although they could withdraw the entirety of their deposit, it highlighted Celsius’ risky investments using its customers’ money.

To top this off, state securities regulators in Kentucky, Alabama, New Jersey, and Texas moved against the platform’s lending products. The regulators consider these Earn Interest (yield) Accounts (EIA) as unregistered securities and risky as investors are not protected by any state or federal protection in a downturn.

Hindsight is 20-20, and in hindsight, it is surprising how a company like Celsius continues to operate. From making risky bets to losing funds to being under regulatory pressure and finally shutting down all withdrawals. However, what does the road ahead look like for Celsius and its trapped retail investors?

In its latest communication on June 20, Celsius says, “We want our community to know that our objective continues to be stabilizing our liquidity and operations. This process will take time.” It also said that they “plan to continue working with regulators and officials regarding this pause and our company’s determination to find a resolution.”

It was recently reported that Celsius has approached Citigroup for advice, including “potential financing” options.

This prompted Simon Dixon, founder of BnkToTheFuture, the lead investor in Celsius, to come out with a proposal called the Celsius Recovery Plan.

Dixon noted that as a Celsius shareholder and lender, he was “keen to support Celsius with a recovery plan” similar to what his company proposed and executed for Bitfinex in 2016 to recover from a hack.

“I believe traditional finance will not have a timely solution for Celsius as we saw in the past with Mt. Gox that still remains unresolved 10 years later. I believe that this can only be solved with a solution using financial innovation like we did with Bitfinex that was resolved within 9 months and worked out very well for depositors.”

Perhaps there is a light at the end of the tunnel. If Celsius can devise an innovative plan and successfully execute it, it might just see a resurgence.

The CEL token is on an upswing and is currently trading at $1.15.