tl;dr Summary: The Financial Services and Markets Bill has been introduced to the UK parliament. The bill will unify regulation of traditional finance and emerging technologies, and includes plans to regulate stablecoins as a form of payment within the UK. Key British politicians remain positive on the emerging digital asset space, in stark contrast to their European colleagues across the channel.

In the UK, as the race to replace ousted Prime Minister Boris Johnson heats up, it seems it is business as usual in the Treasury. The Financial Services and Markets Bill was introduced to the UK parliament on Wednesday, with wide ranging aims to regulate the financial sector, including plans to recognise stablecoins as a form of payment.

The key aims of the Bill can be found on the official UK government website:

The Bill will:

- Implement the outcomes of the Future Regulatory Framework (FRF) Review

- Maintain the UK’s position as an open and global financial hub

- Harness the opportunities of innovative technologies in financial services

- Bolster the competitiveness of UK markets and promote the effective use of capital

- Support the levelling up agenda, promote financial inclusion and consumer protection

The bill outlines the UK’s approach to financial regulation after leaving the European Union, and repeals much of the legislation that was put in place by the European Parliament. The official press release from HM Treasury states that the bill “seizes the opportunities of EU exit” and aims to “bolster the competitiveness of the UK as a global financial centre.”

The content covers the traditional financial markets as well as the emerging digital asset market, however there has been a heavy focus in the official communications on the acceptance of emerging financial technologies, particularly stablecoins. Chancellor Nadhim Zahawi is quoted in the official press release:

“To ensure the UK remains at the forefront of new technologies and innovations, the Bill will enable certain types of stablecoins to be regulated as a form of payment in the UK. In fostering these new innovations, the Bill will also enable the creation of Financial Markets Infrastructure Sandboxes – allowing firms to test the use of new technologies and practices in financial markets, increasing efficiency, transparency and resilience of new products.”

The bill was initially developed by crypto-friendly ex-chancellor Rishi Sunak, who had previously stated that he wanted the UK to become a global centre for crypto technology. After Sunak’s resignation earlier this month, there were fears that the bill’s content could be amended, however it is clear that the new treasury will continue to support his pro-crypto values. Rishi Sunak is now head-to-head with Liz Truss in the race to become the UK’s next Prime Minister, and if the former chancellor is to be successful this will likely lead to even greater crypto-friendly regulation in the UK.

The positive tone from the UK government is in stark opposition to that coming out of the European Union. The EU recently passed the infamous Markets in Crypto Assets bill, which initially looked to ban proof-of-work cryptocurrencies such as bitcoin. The final version of the bill was agreed in June, and included stringent requirements for stablecoin issuers. The EU regulations included a controversial ‘cap’ that restricts each coin to a total daily transaction limit of 200 million euros. The US is expected to follow suit and introduce stablecoin regulation of their own before the end of the year.

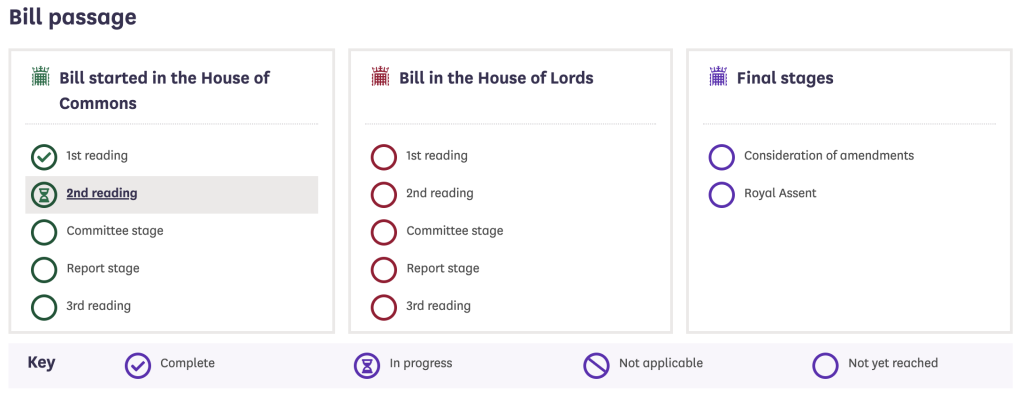

The bill has some way to go before becoming law in the UK, requiring two more readings and committee review in the House of Commons before repeating the whole process in the House of Lords. As such, the final form of the bill remains unclear, however for the crypto community in the UK this is certainly a positive start to the regulatory process!