tl;dr summary: Over the past few weeks, NFTs have begun a massive sell off. NFT volume has been down tens of millions of dollars in the past weeks from their all time highs, and many NFT investors have been feeling the sell pressure. What is the reason for this NFT crash, and could this lead to the NFT bubble burst? Could the NFT market come back to its recent highs this year?

Over the past few weeks, NFTs have begun a massive sell off. NFT volume has been down tens of millions of dollars in the past weeks from their all time high, and many investors have been feeling the sell pressure. According to an article from the New York Times, “At Sotheby’s on Wednesday night, a single lot of NFTs — 104 digital art assets known as CryptoPunks — was expected to sell for as much as $30 million. But after a delay of 25 minutes past the auction’s expected start time, the sale was off.”

If we go back to the start of the NFT craze, several NFT collections like Bored Ape Yacht Club and Crypto Punks gained a lot of steam in late 2021, where we saw several of these Non-Fungible Tokens (NFTs) burst up in value due to a huge social media presence. At one point, it seemed like everyone was talking about NFTs. Mark Cuban, Jimmy Fallon, Eminem, and even Snoop Dogg were some of the many celebrities who were talking about NFTs and even endorsing some.

By the end of 2021, the NFT market had received over $40B in sales, an astonishing amount in just a short time. It seemed like the NFT market would only go up. However, reality started to set in around February and March of 2022. NFT trading volume on Opensea—the most popular NFT trading platform in the world—plunged to new lows. According to ft.com, trading volume on Opensea was down 80% in March compared to the early February highs. Not only this, but the number of accounts trading NFTs plummeted around 50% from all-time highs in November, as traders started a mass exodus of NFTs. We are nearing a point where the NFT market is approaching a giant dump, and the bubble may burst.

What is the reason for this NFT crash, and could this lead to the NFT bubble burst? Could the NFT market come back to its recent highs this year?

Brief Explanation of NFTs

Almost everyone knows what an NFT looks like: weird looking photos or art of apes, dogs, and more. But what actually is an NFT? An NFT is a Non-Fungible Token. Here’s how The Verge describes ‘non-fungible,’ it hits the nail right on the head, “‘Non-fungible’ more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different.” NFTs on the Ethereum blockchain (a popular blockchain for NFTs) are called ERC-721 tokens, and ERC-721 tokens behave differently than regular cryptocurrencies, like an ERC-20 token. These NFTs are codes that lead to files that can be represented by anything digital like a picture, video, music, and more. Sometimes NFTs are stored on the cloud, and other times they are stored on the blockchain.

Ethereum Related Crashes

One thing to recognize about the NFT crash is that it followed the crash of cryptocurrencies like Ethereum. Because Ethereum is one of the main NFT marketplace blockchains, it can influence the NFT market, more specifically with its gas fees. Ethereum’s gas fees are known to be quite high compared to other crypto blockchains, and the gas fees could scare off smaller investors. For example, in order to create an NFT, it has to be minted. According to zipmex, minting an NFT means to, “convert digital files into crypto collections or digital assets stored on the blockchain.” This minting process requires a gas fee to process the transaction on Ethereum. Sometimes, this gas fee on Ethereum can cost more than the NFT itself. However, in the future Ethereum plans to move to Ethereum 2.0, which will greatly decrease the price of gas fees, which could be a good thing for the NFT market.

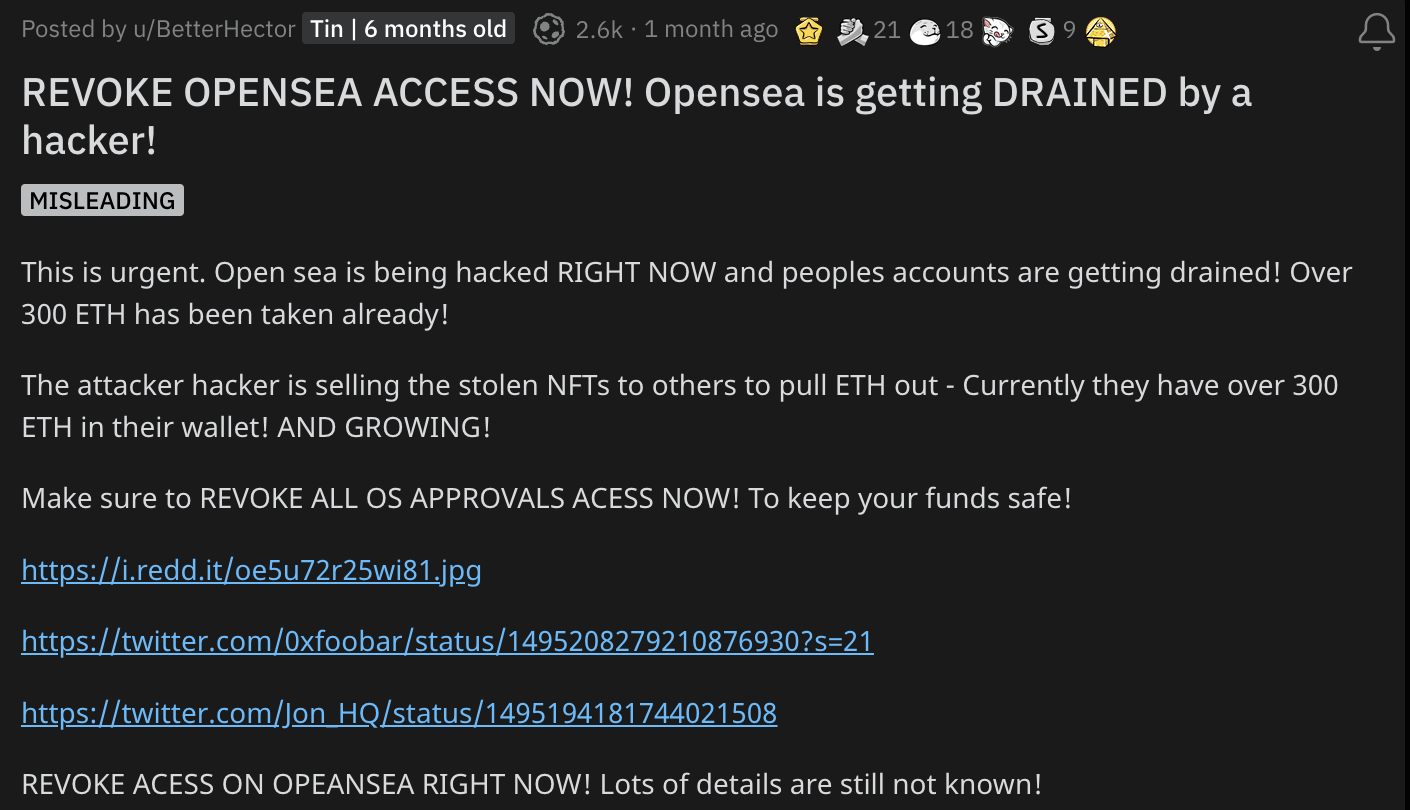

Another thing to think about is recent hacks and problems with popular NFT marketplaces. In late February, there was a phishing attack on Opensea. This attack led to $1.7 million in NFTs being stolen. While some NFTs were given back by the hacker, this still led to some panic with many NFT investors. Since February, NFT sales have been down significantly, so the Opensea hack could also be to blame for the NFT market crash.

NFT Possible Futures

When the dust settles on the damage that this NFT market crash caused, what changes could we see in the NFT market? Well, there is a possibility that the NFT market could follow the same road as the cryptocurrency market. This would be the underperforming of “meme NFTs” or NFTs with no use cases and the growth of utility NFTs, NFTs with use cases. As an example, we can compare this to the fall of cryptocurrencies like Dogecoin and Shiba Inu, both of which have fallen way over 50% from their all time high. As these “memes coins” dropped in price, other coins with utility cases, such as Terra and AVAX grew in value.

Therefore, we could see NFTs that have utility cases start to gain in value, as other NFTs lose market share. In fact, we are already seeing this happen. In the past 7 days, (at the time of this writing – 3/25) 3 of the top 5 NFTs—Bored Ape Yacht Club, Mutant Ape Yacht Club, and Crypto Punks—have each fallen over 30% in trading volume. These NFTs are generally the NFTs people refer to as the most popular NFTs. However, other than showing off that you bought a $300,000 picture of an ape and being invited to BAYC parties, these NFTs don’t have any utility.

Meanwhile, NFTs like Azuki, NFT Worlds, Metroworld Genesis, and many others are going up in trading volume. These are all NFTs that have real world, gaming, or online utility cases.

Is there a chance for NFTs to go back up to their highs before the crash? Yes, there still is a possibility that the NFT market can mature from this crash and reach new heights, however, that still remains to be seen. Whether you agree with NFT’s value or not, it is agreeable that these next months will be crucial for the NFT market.