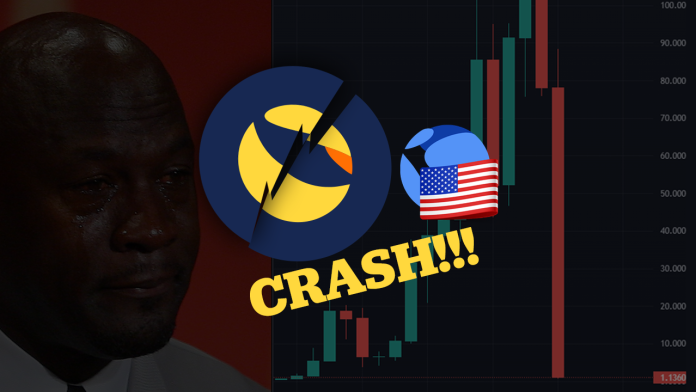

tl;dr Summary: Following a massive sale, the most popular algorithmic stablecoin TerraUSD ($UST) death-spiralled into a devastating loss for its holders as it fell to $0.29 on 11th May but has since recovered to $0.60.

The UST de-pegging story is slowly turning into the next thriller, with interconnecting stories and conspiracy theories beginning to surface involving the infamous Citadel securities and Blackrock of the Gamestop fame.

It all started on 7th May when a seller swapped $85 million of UST for USDC on Curve and created an imbalance between the stablecoins held in the pool.

This imbalance between the dollar represented by USDC (another stablecoin pegged by collateral) brought the price of UST down to $0.98. One UST is algorithmically controlled to be equal to one US dollar, but it slipped to 98 cents because of the transaction.

The Luna Foundation Guard (LFG), a non-profit set up for the Terra ecosystem that runs UST, was prepared for such an event. It had previously bought Bitcoin (BTC) as an additional layer of support if the UST starts to lose its peg (1UST = 1USD) and jumped into action to bring back the balance by selling some of its BTC with the help of market makers.

Funds on Anchor also started to sell their UST positions after seeing this selling pressure in the hopes of pocketing whatever gains they had made and reducing their losses.

When the markets opened on Monday (9th May 2022), the seller continued their swaps on Curve, and the market makers continued to sell BTC to keep the peg, but this did not help as the price of LUNA (the native token of the Terra chain linked to UST) also started to drop because of the broader market conditions which resulted in more selling pressure on UST and LUNA which led to a ‘death spiral.’

At the moment, LUNA has dropped a massive 97% and is trading at $0.043.

By 10th May 2022, UST came down to $0.70 and then to $0.30 on the 11th. At the moment, the price is $0.49.

As LFG kept selling its BTC, the selling pressure started to mount on BTC, which saw its price go down to under $30,000 on the 11th. BTC at the moment is at $28,300. The reduction in the price of BTC also reduced the effectiveness of this ammunition, as they had bought BTC at a higher price compared to its current price.

Amidst all this chaos, the US Federal Reserve released its latest Financial Stability Report on the 9th with a section about vulnerabilities in the stablecoin sector. Later, the treasury secretary Janet Yellen is also seen calling for regulations in stablecoins and citing this event as the reason.

If it is a mere coincidence or a planned series of events cannot be established at this juncture, as more details are coming out. One thing is for sure: this episode has been especially devastating for retail investors who believed in the vision of the chain and its potential.

Yesterday, Do Kwon, founder of Terraform Labs, accepted a community proposal to mint and sell additional LUNA in an attempt to bring back the value of UST to $1.